In the end it all boils down to working within your means and budget. Find out the rate you would qualify for - without having to speak to someone.

In The Uk To Afford A House Worth 700 000 Roughly What Income Do Both Spouses Need To Be Earning Quora

We base the income you need on a 500k mortgage on a payment that is 24 of your monthly income.

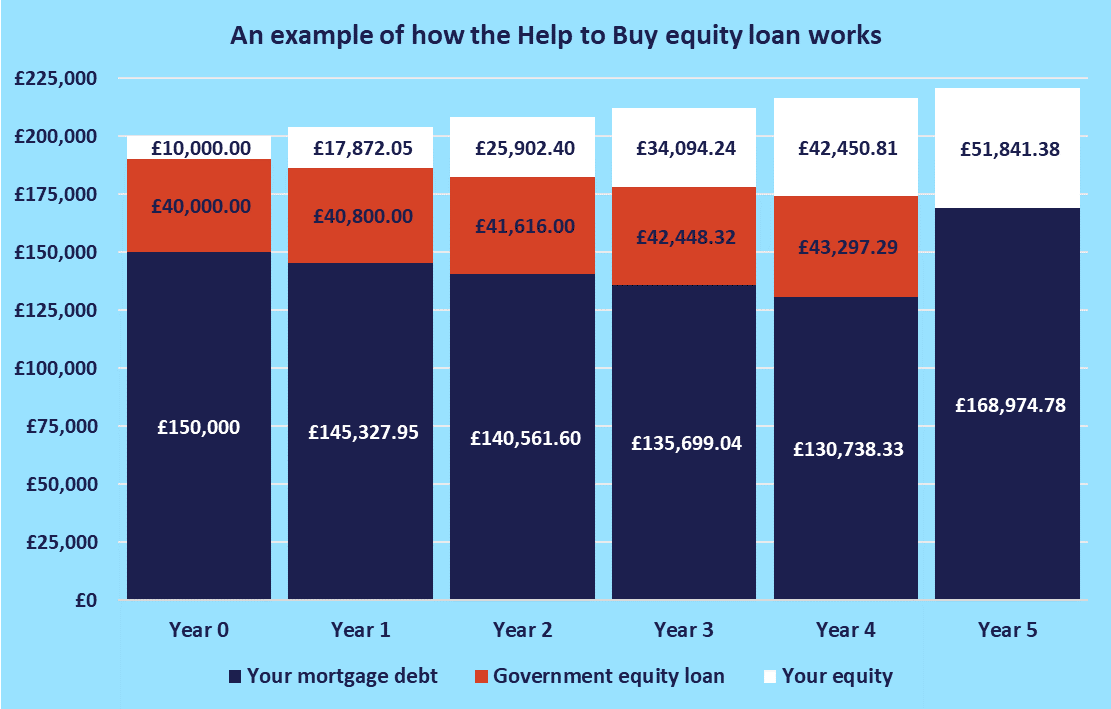

. Otherwise the estimation would change significantly. However most people buying a house of that value particularly outside London will have previous property so youd hope some of the equity released from that during the sale would help you afford a slightly more expensive. Email the 50000000 Mortgage Calculation to yourself.

Mortgage lenders in the UK. It assumes a fixed-rate mortgage. The Income Needed To Qualify for A 500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total annual income.

Ad Self Build Finance - Up 14 Working Days - All Cases Welcome - Online Quote. To Sum it All Up. To achieve that your annual salary after tax would need to be at.

Use the mortgage calculator to provide an illustration of monthly repayment amounts for different terms and interest rates on a 50000000 mortgage. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. To safely afford a 500k house in Singapore generally a household income of 8000 will be a good gauge.

Lets Calculate the payment pt2 42 related questions found. In your case your monthly income should be about 12818. Your monthly mortgage payment would be 2837 if you secured a 45 percent interest rate for a 30-year mortgage.

Salary needed for 500000 dollar mortgage. You can use the above calculator to estimate how much you can borrow based on your salary. You need somewhere between 5000 and 10000 saved up to buy a cheap home 10000 to 20000 for the UK average and around 40000 to 50000 if youre buying in London or another expensive.

The amount of money you spend upfront to purchase a home. If your 500k mortgage is intended for a BTL investment bear in mind that different rules apply than for residential mortgages. Report 7 years ago.

Given that the monthly mortgage of the house is around 1982 there should be some surplus from your income to work with. This means that if you wanted to purchase a 500K home or qualify for a 500K mortgage your minimum salary should fall between 165K and 200K. If you want to be able to afford a 500000 dollar house you will need to make at least 87000 per year or more.

How much is the monthly payment on a 500000 house. These variables can affect the overall cost of getting the house and make it unaffordable if you earn below 100000. Off nothing prior just over 110k most mortgages are for 4 times salary and you pay a 10 deposit.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. This affordability tool helps you figure out how much you. Conclusion can I afford a 500k house.

To afford a house that costs 1000000 with a down payment of 200000 youd need to earn 173721 per year before tax. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. This means that if you wanted to purchase a 500K home or qualify for a 500K mortgage your minimum salary should fall between 165K and 200K.

Ad Sell Faster And For More. As a general rule youll need 5 down even with private mortgage insurance. That is a starting point it assumes youre putting 100k down 20.

Income Multiples For A 500k Mortgage. Most home loans require a down payment of at least 3. Generally lend between 3 to 45 times an individuals annual income.

However you must consider several factors such as the downpayment loan terms and interest rates debt obligations and closing costs based on location. Average Home Price by State. Housing costs of 750 a month would mean you would need to make a minimum take home pay of 2300 a month after tax to keep these costs below a third of your take-home pay.

To buy a 700000 house you would need to make 122000 and make a downpayment of 140000. What is the income needed to buy a 500000 house. A good rule of thumb is to spend no more than 28 of your pre-tax income on your mortgage payment.

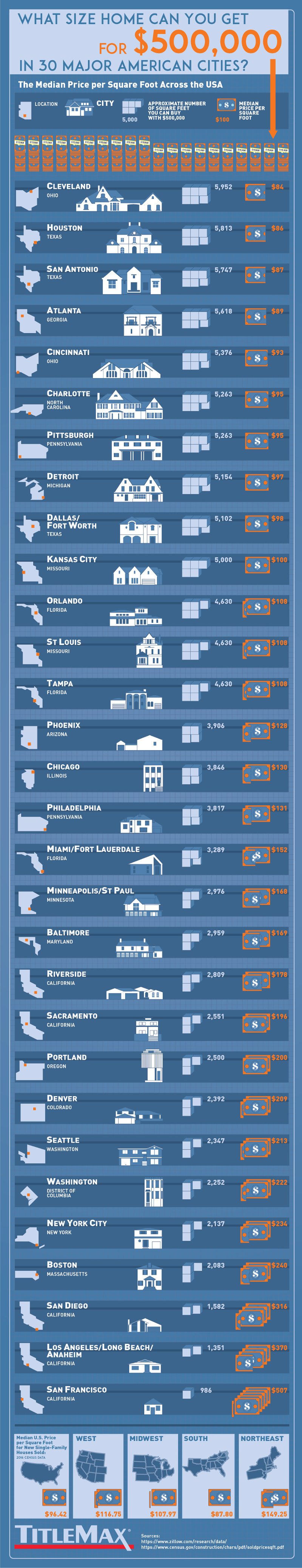

How much house can you afford in New Jersey New Jersey 5 replies Where in nj to buy a house with 500k-600k New Jersey 7 replies Pick a town in NJ for 500k or under New Jersey 15 replies How Much To Afford A House In NJ New Jersey 87 replies. You need to make 153812 a year to afford a 500k mortgage. In the table below we highlight how much income you will need either as a sole applicant or combined with another applicant to secure a mortgage of 500000 at different income multiples.

Take a few days and mull over whether you really want to commit to that monthly interest repayment before you commit to the Mortgage. Check Local Estate Agents Fees. So to afford a 500k home youd want to make around 167k per year.

This page will calculate how much you need to earn to buy a house that costs 500000. Some lenders will require a large deposit of at least 25 although most will be happy with 15 subject to your other circumstances. So youll need 25000 cash on hand.

You can afford a house of 500k by earning anything from 74607 before tax.

What Do I Need To Buy A 500k House Deals 53 Off Empow Her Com

What Do I Need To Buy A 500k House Deals 53 Off Empow Her Com

Ultimate First Time Buyer Guide How Much Money Do You Need To Buy A House

What Do I Need To Buy A 500k House Deals 53 Off Empow Her Com

How Much Do I Need To Buy A 500k House Best Sale 58 Off Www Ingeniovirtual Com

What Can You Build For Your Budget Build It

What Do I Need To Buy A 500k House Deals 53 Off Empow Her Com

What Is The Income Needed For A 500k Mortgage By Pierre Carapetian Medium

0 comments

Post a Comment